In the Financial Informer Second Quarter 2021, we dive into the accumulation of wealth, caring for children after you’ve gone as well as estate planning and Wills management.

How Richie Remains Rich

The accumulation of wealth isn’t something that (usually) happens overnight. It is also something that has to be managed and maintained successfully. There have been many fortunes lost but this is how quite a few have been retained.

A common discipline that’s continued to sustain a lot of high net-worth individuals to build and retain their wealth has been the appreciation for sound financial advice, money management, and legacy planning through their journeys. For individuals and families who have already made their fortune and are looking to grow and retain it, emphasis is often placed on actively managing and growing their wealth through various wealth creation tools for future generations.

Accumulating wealth often happens over time as part of a varied and long-term strategy to increase net worth. Although there is an influx of strategies to grow wealth through all life stages and seasons, there isn’t a one size fits all approach as every individual or family is unique. However, it is nevertheless important to understand the values that govern wealth generation and apply them to your own unique strategy.” Wealthy families abide by some common principles to build their wealth. These are some of the guiding principles for growing wealth; which constitute mastering the art of managing your money and assets to increase wealth.

Add button: Download

Someone to watch over me

One of the most important jobs we have as parents is making sure our children are well cared for and protected. But how do we ensure this continues long after we are gone? Do we like thinking about it? Oh hell no we don’t but ignoring it would result in an unthinkable situation for those you love the most.

First of all, you have to have a valid will in place. If a parent dies without a will, it can create numerous challenges. For example, the child’s inheritance will be paid into the State Guardian Fund, which can mean a lengthy process before funds can be accessed. When you have minor children, it is also vital that you nominate a guardian. Should you pass away without doing this, it triggers a debate around who will look after your children and this is not a decision you want to leave to someone else.”

Add Download button

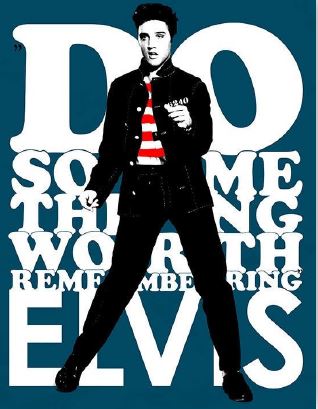

One for the money

Elvis Presley’s estate is reputed to have lost 73% of its wealth to estate taxes and fees. However, estate taxes are not only a problem for the rich and famous. This article explains how estate duty works and why you should consider its potential impact on your estate.

Elvis Presley’s estate is reputed to have lost 73% of its wealth to estate taxes and fees. However, estate taxes are not only a problem for the rich and famous. This article explains how estate duty works and why you should consider its potential impact on your estate.

“Last Will and Testament – I, the testator, being of sound mind, do hereby leave and bequeath upon the South African Revenue Service, in consideration of their kindness and benevolence to me during my lifetime, a cash amount to the value of 1/5th of my estate.” Seemingly an extract from the Will of a deranged madman, but in effect not necessarily beyond the realms of possibility. Estate duty can play havoc with your testamentary planning and it’s not only the mega-wealthy that should be concerned.

Click the Button Below to Download the Full Financial Informer Second Quarter 2021!