We are now working with Carlton James Group to bring you some of their best investment options!

The DAF fund makes loans to high quality, structurally growing businesses which have the ability to do the following:

• Ensure continued demand and potential for growth through every stage of the economic cycle.

• Adapt to the rapidly changing demands of the modern world

The fund lends money to specifically targeted and selected sectors which are predictable, recession resistant and defensive to ensure protection of investor capital from recession and volatility.

4 Key Investment Sectors

Sports Media

Sports Media

Media – defensive sector, Sport ʻspeeding bulletʼ for growth

Historically strong returns across all stages of the economic cycle

Gives the fund great opportunity for alpha returns over and above the 8% target

Renewable Energy

Renewable Energy

Renewable energy – ʻspeeding bulletʼ sector, expected to grow very quickly

Energy is a defensive sector – doesnʼt follow the general market

Typically a low volatility sector

Commercial Real Estate

Commercial Real Estate

Marketplace is cyclical – follows general economic health

Mass data makes CRE easier to prepare for in all stages of the economic cycle

DAF makes secured lending facilities against all developer assets, not against a specific site

Technology

Technology

DAF makes loans for ʻComplimentaryʼ technologies – easy to deploy into the existing market

Technology enables cost saving and promotes eff iciency for companies and people, usually gaining more traction in an economic downturn DAF typically lends to technology companies within its key target sectors

DAF HIGHLIGHTS

• Carefully risk managed venture debt strategy

• Targeted core return plus potential of additional capital growth

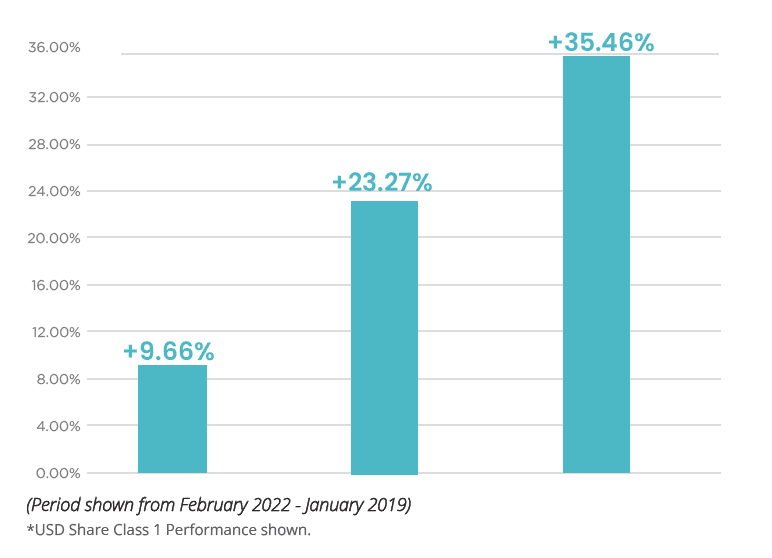

• Proven 3+ years track record

• Historic returns exceed annual targeted core return since inception

CUMULATIVE PERFORMANCE

DAF OBJECTIVES

• Protect capital against excessive market volatility

• Deliver targeted core net return of 8% per annum

• Additional ’Alpha Strategy’ for potential of greater returns

• Plan and prepare for all market conditions